How cost estimates help you get the best out of your GM programme

Author: Georgia Wilson, ECA International

It is no secret that international assignments and even permanent transfers can be very expensive, but does your organisation know just how much they are costing? Monitoring and controlling the costs of assignments are both consistently a major concern for global mobility (GM) teams and their organisations – in fact, more than half of companies participating in ECA International’s latest Managing Mobility Survey reported that these are currently significant challenges for them.

This is where cost estimates come in; they enable companies to determine how much potential international moves will likely cost before they begin. This insight is indispensable to different stakeholders across the business and is used for a range of purposes:

- Improving management approval workflow: Decision makers use cost estimates to assess whether a given assignment or permanent relocation is worth the significant investment and to reduce the chance of unpleasant surprises further down the line. Companies may therefore choose to incorporate the preparation and sign-off of a cost estimate in their standard assignment process.

- Budgeting: For the business unit bearing the expense, knowing the expected cost of an assignment means that it can be incorporated into its budget.

- Evaluating different scenarios: Companies are more likely than ever before to use a greater variety of international move types, and GM teams can use cost estimates to evaluate and compare different scenarios. Traditional long-term assignments remain popular, but in some cases short-term assignments and permanent relocations are attractive alternatives. Even for long-term assignments, there are different types when it comes to pay – it can be calculated based on a home salary starting point (i.e. the salary for the equivalent job in the home country) or a host salary (i.e. the local market rate in the host country). Some use the cost estimates to make comparisons between the cost of continued employment in the home location and the cost of an assignment. With many organisations having a stronger focus on the bottom line, looking at the different possible scenarios in advance can be a useful tool when GM is seeking management buy-in.

- Designing and maintaining a business-enabling GM programme: One of the key purposes of a GM programme is business enablement. Having the ability to accurately project costs to support the business in their daily operations will help GM managers demonstrate the value of their programme.

- Producing project bids: Many companies, particularly those in the construction and energy sectors, need to tender for projects that will require international assignments. Estimating labour costs is usually an important part of how companies’ bid teams calculate rates and safeguard margins.

The building blocks of a cost estimate

What is included in a cost estimate? Typically, costs are split into four components: salary, annual benefits, one-off relocation costs, and tax and social security liabilities:

- Salary: For any type of assignment, salary and bonus payments make up a large part of the total costs. Where the assignee is entitled to additional allowances and pay adjustments as part of their assignment salary, these amounts are taken into account. Cost of living adjustments (i.e. COLAs) are usually provided for long-term assignments where the package is home-based, whereas an allowance to cover daily essentials is typical for a short-term assignment. Assignment allowances and location allowances are also often given. When the salary is host-based – and this could be the case for either a long-term assignment or a permanent transfer – then the gross salary to be paid in the host location is usually all that needs to be considered (and any bonus payments).

- Annual costs: On top of salary, other annual costs need to be considered as well. These are made up of ongoing benefits provided during the assignment (or, for permanent transfers, benefits provided during the first year). Accommodation is usually the largest expense; in some locations, this cost can even exceed the cost of the salary. Other benefits that may be included are utilities, education costs for children, a company car, home leave, medical insurance and annual tax return preparation – and the costs incurred will depend on in the assignee’s destination and the size of the relocating family. While the benefits provided will vary from one move type to another, this component still increases the package significantly.

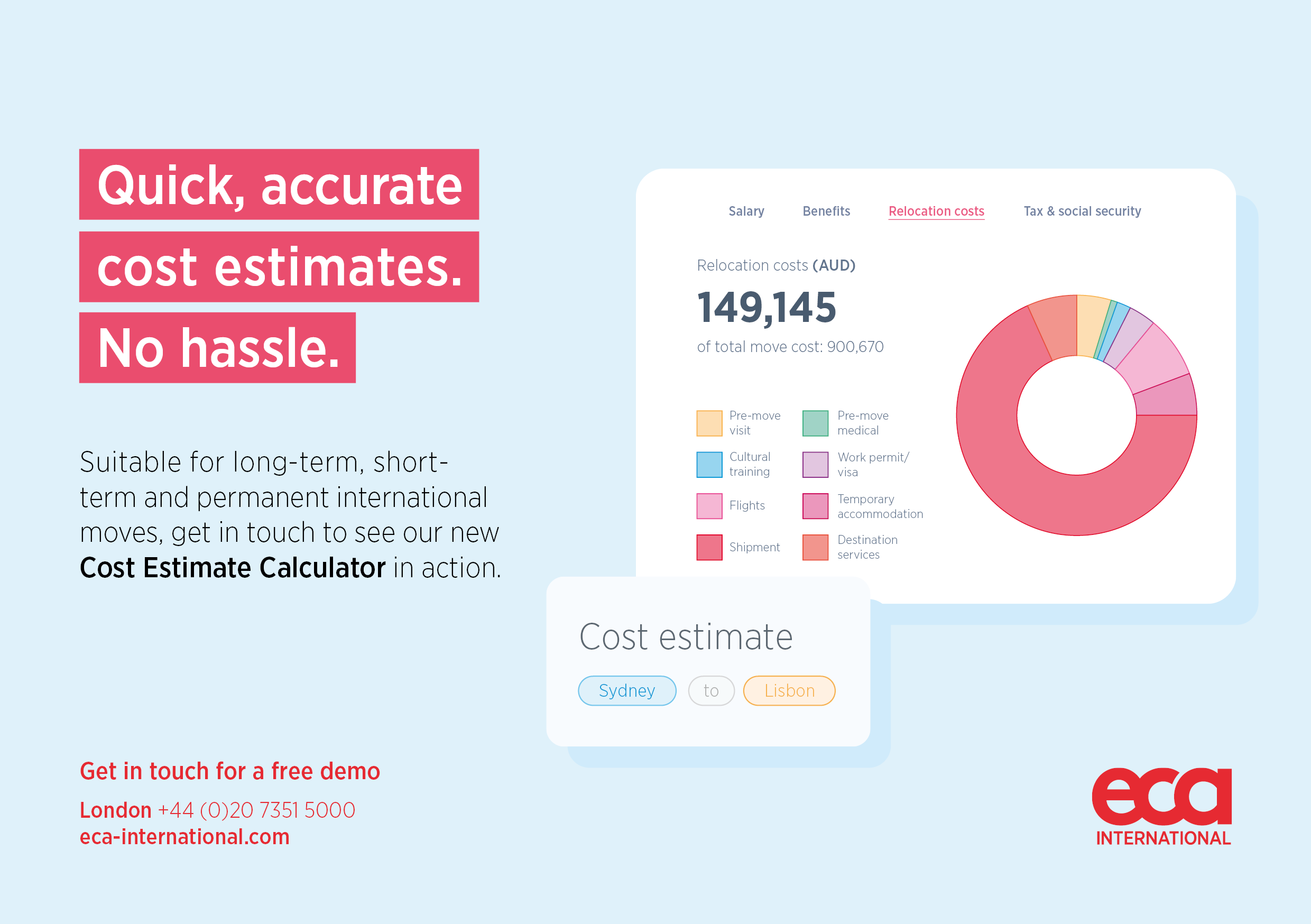

- One-time costs: Most companies also factor in the one-time costs incurred at the start of a move (and at repatriation in the case of assignments). Some of the more significant costs relate to the physical act of relocating an employee and their family to another location. As with the annual costs, costs for flights, shipment of personal effects, temporary accommodation, and other similar expenditure will vary considerably depending on the circumstances of the assignee and the locations between which they will travel. The relocation costs of repatriating should also be considered for assignments, though these will of course not apply for permanent transfers.

- Tax and social security: Finally, on top of salary payments, benefits and relocation costs, the thorny issues of tax and social security must be considered. Together these have the potential to make up a substantial proportion of the overall cost of a move. The elements of the package that are taxable and the rates at which they are taxed will vary depending on each host location’s fiscal law. When an assignee’s pay is home-based – for either a long-term or short-term assignment – their package is normally tax equalised. Their salary, benefits and relocation costs are quoted net and the company meets the income tax and social security contributions (employee and employer) incurred on these. When an employee is quoted a gross host salary for a long-term assignment, the employer usually still pays any tax that arises on move-related allowances, benefits, and relocation support. In permanent transfer cases, normally the employee is quoted a gross host salary and required to pay any tax that arises on the additional benefits and relocation support provided, with the employer required to pay social security contributions due on the package.

.png)

The benefits of knowing what assignments will cost

Making cost estimates an integral part of the mobility process improves cost awareness and control. Often the only part of the business with a good idea of the total costs of an assignment is the GM team. Cost estimates allow better communication of these costs to relevant stakeholders in a clear and accessible way. This greater awareness inevitably improves cost control; faced with information on the significant outlay, the business unit bearing the cost will see it needs to be justified by a clear business rationale if the assignment is to go ahead.

Going further than cost control, if cost reduction is a priority, then demonstrating the full costs to the business can encourage the implementation of more stringent approval requirements for assignments. Being able to compare various scenarios will also enable the business to select the most cost-efficient move type. Where a choice of the assignment location is an option, a cost estimate will provide clarity on where to base the assignee.

Using software to unlock the full benefits of cost estimates

While cost estimates come with many advantages, creating them manually comes with challenges. It is typically time-consuming to gather data from HR teams and a vast range of different vendors, not to mention that running the calculations themselves is intricate work and requires a certain amount of in-house GM knowledge. Mobility teams, especially those under significant time and workload pressures, may therefore not be in a position to run cost estimates regularly or consistently.

Software specifically designed for running cost estimate calculations removes such obstacles. ECA’s 2022 Global Mobility Now Survey found that 4 in 10 companies are already using software to automate calculations like cost estimates, whereas 5 in 10 say they are not currently automating these yet believe that it would add value for them – and for good reason. Cost estimate calculators already configured with mobility and tax data save considerable time and reduce the risk of human error. Clear and attractive outputs from a specialist system are also quick to share, and are much easier for other parts of the business to review and understand than large and detailed spreadsheet files full of manual workings. Ultimately, transparency and easy communication is at the heart of why using cost estimates encourages better decisions and helps to hone businesses’ mobility programmes.

Georgia Wilson

Georgia is part of ECA’s Client Services team and is responsible for some of ECA’s key accounts in northern Europe. She advises major multinational companies on current practices in global mobility, and supports the use and development of software solutions. She also regularly contributes to ECA’s blogs and webinars as well as speaking at ECA events. Previously, Georgia worked in ECA's Accommodation Services team.